As of April 4, 2025, here are the latest developments in the Ethereum ecosystem:

Pectra Upgrade Imminent

The Pectra upgrade for Ethereum Network will occur on April 8, 2025. The major update integrates ideas from 20 Ethereum Improvement Proposals which focus on improving scalability and security and enhancing user experience. The improvement process will expand into two stages where phase one incorporates roughly ten EIPs followed by phase two which brings additional changes.

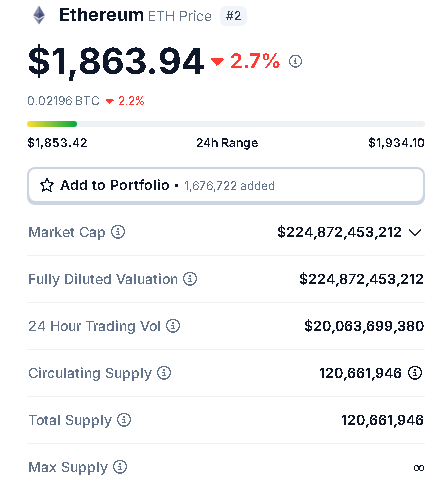

Market Analysts Divided on ETH Price Trajectory

Markets experts provide dissimilar forecasts about Ethereum’s market value for April 2025. Ethereum price projection models indicate a possibility for prices to drop below $1,500 according to market sentiment and technical analytics. Traders formatted a $4 billion rise in open interest during three weeks which indicates they are betting on a bullish price breakout.

Regulatory Developments Impacting Ethereum

The U.S. House Financial Services Committee will discuss the STABLE Act as a bill intended to implement stablecoin regulations. The proposed legislation may affect both Ethereum-based stablecoins and the whole decentralized finance (DeFi) infrastructure

Ethereum’s Competitive Landscape

Ethereum must compete with multiple blockchain platforms that exist in the market. Studies show Avalanche (AVAX) might eclipse both Bitcoin and Ethereum on the market to reach a value of $250 by the year 2029. Aside from Ethereum there are Solana (SOL) and Cardano (ADA) blockchain platforms which indicate positive momentum for upcoming substantial price increases.

Long-Term Outlook for Ethereum

Looking ahead, Ethereum is expected to experience significant growth. Some forecasts suggest that ETH could reach a maximum level of $6,563 by 2025, driven by technological advancements and increased adoption.

Ethereum plans to implement the Pectra Upgrade during April 8, 2025. This upcoming update combines Prague and Electra updates to improve the features of its blockchain system. The Pectra upgrade unites Prague and Electra into a single development to enhance various features across the Ethereum blockchain. The main focus areas include:

Key Changes in the Pectra Upgrade

1.EIP-3074 Implementation – This will allow externally owned accounts (EOAs) to perform smart contract-like operations, improving user experience and reducing transaction fees.

2.Gas Optimization –Pectra introduces optimizations to lower gas fees, making transactions and smart contract interactions more efficient.

3.Account Abstraction Enhancements – This feature will make Ethereum wallets more user-friendly by improving how accounts handle transactions and security.

4.Scalability Improvements –The upgrade will help Ethereum handle more transactions per second, making it more competitive with other blockchain platforms.

Ethereum’s Market Trends & Potential Price Movement

The increasing interest in Ethereum futures contracts indicates that traders predict a significant market event approaching. However, analysts remain divided:

- Bearish case: If ETH fails to hold above key support levels, it could dip below $1,500 due to macroeconomic factors and market corrections.

- Bullish case: With a $4 billion rise in open interest, some traders expect ETH to break past $3,500 or even approach $6,500 by late 2025.

Upcoming Regulatory Developments

Ethereum is also facing potential regulatory scrutiny:

- Stablecoin companies USDC and DAI would be affected by the U.S. STABLE Act which operates on the Ethereum platform.

- Institutional Adoption:The growing number of institutional investors displays interest in Ethereum while companies embrace its solutions for business use.

Ethereum vs. Competitors

Ethereum holds the position as the top smart contract platform despite competition from SOL, AVAX and ADA. According to analysts these platforms will try to wrestle Ethereum’s top spot if Ethereum cannot manage efficient scaling.

Institutional Adoption & Real-World Use Cases

Ethereum is gaining traction in traditional finance, gaming, and enterprise solutions:

- BlackRock & Fidelity are exploring Ethereum-based financial products, including a possible spot ETH ETF.

- Visa & Mastercard are integrating Ethereum’s layer-2 solutions for cheaper and faster cross-border payments.

- Gaming & NFTs – Ethereum remains the dominant blockchain for digital assets, with major gaming companies launching NFT-based projects on Ethereum.

ETH Price Predictions for 2025-2030

Market analysts have varying predictions for Ethereum’s price over the next few years:

- Short-Term (2025) – Analysts predict ETH could surpass $4,500 if institutional adoption grows and Pectra improves usability. However, some fear regulatory challenges could push ETH below $1,500. Mid-Term (2026-2027) – With the launch of full Danksharding, Ethereum could hit the $10,000+ mark as network efficiency improves.

- Long-Term (2030) – If Ethereum successfully scales and maintains its dominance in decentralized finance (DeFi) and NFTs, prices could range between $15,000 to $30,000.